Title: The Impact of Blockchain Technology on the Financial

- By tp官方安卓最新版本

- 2025-12-08 16:01:46

Introduction to Blockchain in Finance

Blockchain technology has emerged as a groundbreaking development in the financial sector, revolutionizing the way transactions are conducted and data is managed. Originally created as the underlying technology for cryptocurrencies like Bitcoin, blockchain has evolved to gain traction across various industries, particularly finance, due to its capacity for enhancing security, transparency, and efficiency. This shift towards a decentralized financial ecosystem is characterized by reduced reliance on traditional intermediaries, paving the way for a new era of financial transactions.

At its core, blockchain is a distributed ledger technology (DLT) that enables information to be stored across a network of computers, guaranteeing a high degree of data integrity. The immutability of transaction records, combined with the encryption methods used, not only decreases the likelihood of fraud but also fosters trust among participants. Furthermore, DLT allows for faster transaction processing times, which is particularly advantageous in increasingly digital and fast-paced financial markets.

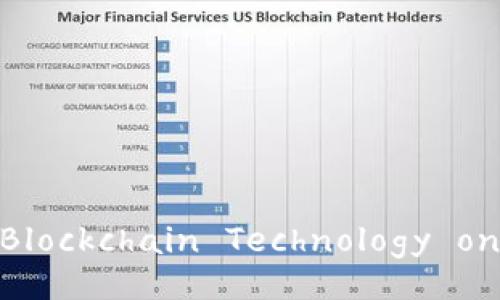

The Evolution of Financial Services with Blockchain

The application of blockchain technology in finance is multifaceted, affecting everything from payment processing to asset management. One of the most notable advancements has been the rise of cryptocurrencies, which utilize blockchain technology to create a decentralized medium of exchange that can operate independently of traditional banks. Cryptocurrencies like Bitcoin and Ethereum have gained popularity as alternative investment vehicles and methods of transferring value across borders.

In addition to cryptocurrencies, blockchain has facilitated the development of smart contracts—self-executing contracts with the terms of the agreement directly written into code. These contracts can automatically enforce and execute terms once predefined conditions are met, significantly reducing the need for intermediaries in various transaction scenarios. As a result, the speed and efficiency of financial transactions can be vastly improved.

Advantages of Blockchain in Financial Services

The integration of blockchain technology provides numerous advantages for financial institutions and their customers. Some of the key benefits include:

- Enhanced security: Blockchain uses cryptographic techniques to encrypt data, making it nearly impossible for hackers to alter transaction records.

- Increased transparency: All users in the blockchain network have access to the same information, fostering trust among users.

- Cost savings: By eliminating intermediaries, blockchain technology substantially reduces transaction costs for both institutions and consumers.

- Faster transactions: Blockchain enables near-instantaneous transactions, particularly beneficial for cross-border payments.

- Decentralization: The distributed nature of blockchain prevents any single point of failure, thus enhancing reliability.

Challenges Facing Blockchain Adoption in Finance

Despite the notable advantages, the widespread adoption of blockchain technology in the financial sector is not without its challenges. Some of the primary obstacles include:

- Regulatory hurdles: The regulatory framework surrounding blockchain and cryptocurrencies varies significantly by region and is often uncertain, hindering investment.

- Scalability issues: Many blockchain systems struggle to handle the large volume of transactions that traditional financial systems can process, which limits their current applicability.

- Security concerns: While the blockchain itself is secure, vulnerabilities exist in the platforms and applications built on top of it, which can lead to cybersecurity threats.

- Technical complexity: Implementing blockchain technology requires a significant technological understanding and skilled personnel, posing barriers for some organizations.

Real-World Applications of Blockchain in Finance

The financial sector has witnessed several practical applications of blockchain technology that demonstrate its potential. Some notable examples include:

- Cross-border payments: Traditional international money transfers can be slow and costly. Blockchain simplifies this process, reducing transaction fees and enhancing speed through solutions like Ripple.

- Trade finance: Blockchain enhances transparency in trade finance by providing a single source of truth for all parties involved, reducing fraud and ensuring the authenticity of documentation.

- Identity verification: Blockchain can streamline the process of verifying identities, aiding in compliance with Know Your Customer (KYC) regulations while reducing the risk of identity theft.

- Decentralized finance (DeFi): DeFi platforms leverage blockchain to provide financial services such as lending, borrowing, and trading without traditional intermediaries, empowering users with greater control over their assets.

Future Trends and Innovations in Blockchain Finance

The future of blockchain technology in finance looks promising, with several trends on the horizon. Key developments that may shape the landscape include:

- Integration with IoT: The blending of blockchain and Internet of Things (IoT) technologies can lead to real-time data management and improved operational efficiency in finance.

- Tokenization of assets: The tokenization of real-world assets using blockchain could enable fractional ownership, increased liquidity, and broader access to investment opportunities.

- Central Bank Digital Currencies (CBDCs): Many nations are exploring or piloting CBDCs, reflecting a trend towards digitized fiat currencies that could offer the benefits of blockchain without losing government oversight.

- Interoperability between blockchains: Future advancements may include the development of solutions that allow different blockchain systems to communicate and interact seamlessly, expanding the utility of these technologies.

Frequently Asked Questions (FAQs)

1. How does blockchain improve the security of financial transactions?

Blockchain technology significantly enhances the security of financial transactions through several core attributes. Firstly, its decentralized nature thwarts the vulnerabilities associated with centralized systems, as no single entity holds complete control over the data. Each transaction is validated by a consensus mechanism, ensuring that multiple participants in the network agree on its authenticity.

Moreover, blockchain employs advanced cryptographic techniques to encrypt transaction data. This means that even if someone gains access to the network, they cannot alter or steal information without the cryptographic keys. Each transaction is also linked to the previous one through a hash function; altering one block in the chain would require concurrent changes to all subsequent blocks, thus making it possible to detect tampering easily.

Furthermore, the permanent and immutable nature of blockchain records means that once a transaction is recorded, it cannot be erased or modified. This attribute significantly reduces the potential for fraud and unauthorized activities, establishing a reliable historical record that can be audited in real time. In summary, the combination of decentralization, cryptographic security measures, and immutability collectively enhances the security of financial transactions in significant ways.

2. What are the implications of cryptocurrencies on traditional banking?

The rise of cryptocurrencies is poised to have far-reaching implications for traditional banking, challenging existing financial paradigms. The decentralized nature of cryptocurrencies allows individuals to conduct transactions without the need for banking intermediaries, which may lead to a decrease in dependency on traditional banking services. As more individuals and businesses adopt cryptocurrencies for payments, banks may face declining transaction volumes from their conventional services.

Moreover, cryptocurrencies provide an alternative investment avenue for consumers, potentially diverting funds away from traditional savings and investment products offered by banks. Those seeking higher returns may turn to digital currencies instead of conventional interest-bearing accounts. This shift in consumer behavior presents both a challenge and an opportunity for banks to adapt or innovate to retain their customer base.

Additionally, banks may be forced to reevaluate their operational models, as they compete with agile fintech companies that leverage blockchain's capabilities. This evolving landscape pushes banks to explore their own blockchain implementations, digital currencies, and collaboration with fintech innovators to serve the growing demand for quicker, more affordable financial services.

3. What challenges do blockchain-based financial services face in terms of scalability?

Scalability is among the most critical hurdles impeding the broader adoption of blockchain technology in financial services. While blockchain can efficiently process transactions, many existing blockchain platforms face limitations regarding the number of transactions they can manage concurrently. Traditional financial systems, such as credit card networks, can handle thousands of transactions per second, while some prominent blockchain networks may struggle to meet this demand under peak loads.

One of the primary reasons for this limitation is the consensus mechanisms employed by many blockchain systems. For example, proof of work—which secures networks like Bitcoin—requires substantial computational power, resulting in slower transaction speeds as the network grows. As the number of users increases, the time taken to process each transaction can lead to bottlenecks, causing delays and a negative user experience.

To address these issues, various solutions are being explored. Techniques such as sharding, layer-2 solutions (like the Lightning Network for Bitcoin), and alternative consensus methods (such as proof of stake) aim to increase transaction throughput and reduce latency. As scalability issues are resolved, blockchain technology can move closer to matching the efficiency and capacity of traditional financial systems, facilitating broader adoption across the industry.

4. How can blockchain technology enhance compliance in the financial sector?

Blockchain technology offers unique features that can significantly enhance compliance within the financial sector. Financial institutions must adhere to a myriad of regulatory requirements, including anti-money laundering (AML) and know your customer (KYC) regulations, the enforcement of which can be resource-intensive and complex. Blockchain provides a robust framework for facilitating these compliance measures more efficiently.

Firstly, blockchain's transparency allows regulatory authorities to access real-time transaction records readily. This transparency fosters greater accountability, making it easier to identify suspicious activities. In conjunction with blockchain’s immutability, all transactions become auditable, reducing the risk of fraud and enabling streamlined investigations into financial malpractices.

Furthermore, integrating identity management solutions on a blockchain can simplify the KYC process. By linking customer identities to their blockchain wallets, financial institutions can create a consolidated view of each customer's history without the need for repetitive document submissions. Once verified, this data can be shared across institutions as necessary, preserving user privacy while ensuring compliance.

Overall, blockchain technology can transform compliance procedures into more efficient and less intrusive processes, allowing financial institutions to focus on their core operations while effectively meeting regulatory obligations.

5. What is the future of decentralized finance (DeFi) and its influence on blockchain adoption?

Decentralized finance (DeFi) represents one of the most significant applications of blockchain technology, promising to reshape traditional financial frameworks. DeFi encompasses a suite of financial services, including lending, borrowing, and trading, all designed to operate on blockchain platforms without relying on traditional intermediaries such as banks or brokerages. The rise of DeFi is driving blockchain adoption as individuals increasingly seek alternatives to conventional finance systems.

The core principle of DeFi is to democratize financial access, providing services to anyone with an internet connection, particularly in regions where traditional banking systems are limited. This shift enables previously unbanked populations to access financial services, fostering economic inclusion and empowerment.

DeFi's influence on blockchain adoption extends beyond increased user engagement; it also encourages innovation in the underlying technology. As DeFi products gain traction, developers are driven to improve the scalability, interoperability, and user experience of blockchain networks. Consequently, the need for solutions that address existing limitations stimulates further investment in blockchain research and development.

Moreover, as DeFi projects grow, they pose unique regulatory challenges, prompting discussions on how to effectively regulate this emerging sector without stifling innovation. As regulators evolve their frameworks to address DeFi, it will influence the trajectory of blockchain technology adoption, balancing innovation with consumer protection and financial stability.

--- In conclusion, blockchain technology is poised to significantly reshape the financial services landscape, offering enhanced security, transparency, and efficiency. While challenges remain, the potential for growth and innovation within this sector is immense. The continued evolution of blockchain and its applications will likely herald a new era in financial transactions, catering to the changing demands of consumers and businesses alike.